This article was featured in One Story to Read Today, a newsletter in which our editors recommend a single must-read from The Atlantic, Monday through Friday. Sign up for it here.

In the 11 years I’ve had a Netflix subscription, it didn’t occur to me until a few weeks ago that I could just cancel it, or that I might want to. For most of my adult life, the service has functioned as something of an entertainment utility: first, because I was far too broke to afford cable, and then, once Netflix turned on its fire hose of original shows and movies, because everyone seemed to be constantly shrieking about House of Cards or Stranger Things or Tiger King. The price crept up over the years, but paying for it has felt like the cost of doing business, if that business is understanding what the hell your friends are talking about during the first round at happy hour.

Then I bought a new television. If you haven’t had to do that in the past three or four years, as Netflix’s streaming competitors have multiplied and attracted tens of millions of new users, an annoying surprise might await you. One by one, you will have to recall every streaming service you currently pay for, download any apps you need that don’t come preloaded, arrange their avatars on your new TV’s main menu, remember your passwords, and slowly navigate an onscreen keyboard with the remote control’s impotent little arrow buttons. It’s an undignified process, and I got more and more irritated with myself as it went on. Why am I paying for these things? How much of this stuff do I even enjoy?

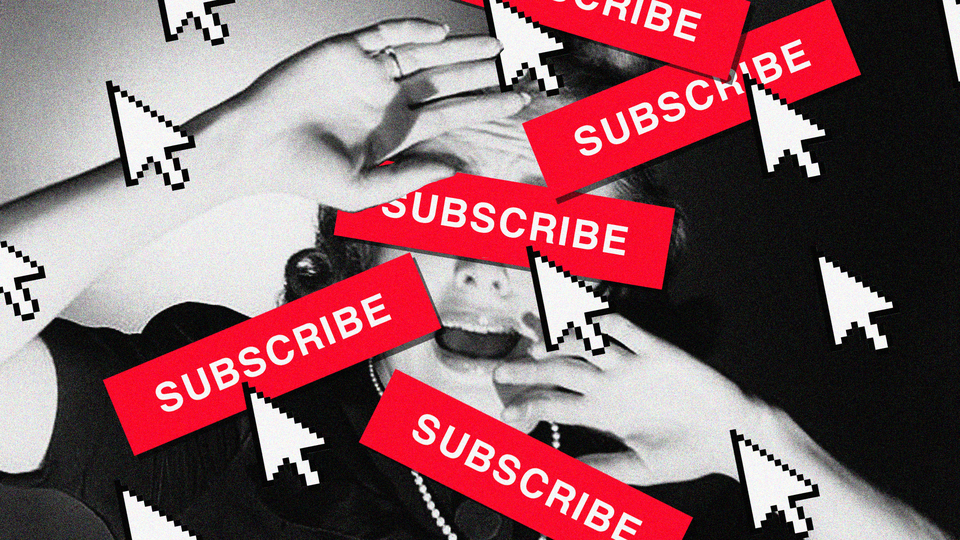

I didn’t cancel anything right that second, but it was the kind of light-bulb moment that has stuck with me as I peruse my credit-card statements or shuffle through apps looking for something to watch on TV, trying to divine what constitutes an acceptable return on, say, five or 10 bucks a month. It was the kind of moment that millions of oversubscribed Americans are bound to have eventually, if they haven’t already. The pandemic has been a boom time for subscriptions; not only have flashy streaming services for all kinds of video and audio content proliferated and grown, but delivery memberships for takeout, groceries, cleaning supplies, toys, supplements, raw meat, and virtually everything else have seen their subscriber bases swell. The same is true for some publications (including The Atlantic—we’d love it if you’d subscribe), Substack newsletters, and Patreon podcasts. No one is sure how many subscriptions the average household will bear before it snaps and starts canceling things, but we might be about to find out.

The maturity of the subscription market varies by industry, but in some of the categories best known for these kinds of services, there are indicators that the ceiling is close, at least in the United States. In streaming video, Netflix has long been the industry standard, but its growth rate has begun to decline, and some analysts believe that it doesn’t have much room left to find new eyeballs in America. Paul Hardart, a marketing professor and the director of the Entertainment, Media & Technology Program at NYU’s Stern School of Business, pointed out to me that when ViacomCBS recently announced that it was changing its name to Paramount to go all in on its subscription streaming platform, Paramount Plus, the company’s stock sank—an indicator, he said, that investors are unsure of how much money is left to be made.

Meanwhile, Amazon Prime already has an estimated 150 million users in the United States—well over half of all adult Americans—and it now costs $139 a year. Like any other subscription service, Prime has some natural limits to its customer base: It can expand only among the portion of the population that can afford its fees and wants to shop regularly at Amazon. And subscriptions to physical products have been faltering for years, as early investor darlings such as Blue Apron and Birchbox have struggled to retain customers and turn a profit.

The subscription model has proliferated over the past decade for similar reasons across markets, according to Robbie Kellman Baxter, the principal at Peninsula Strategies and the author of two books on subscription businesses. Online shopping desensitized people to giving out their credit-card number. Software that businesses employ to create and manage subscription programs has become widely available and easier to use. People who have had a good experience with a ubiquitous subscription service—Netflix or Spotify or Amazon Prime—will generally be more open to trying more. But the most important reason, Baxter told me, is that subscription services, when run well, are extremely good business. They make customers more loyal and provide steady, predictable revenue and detailed data on how each individual behaves. That can make a business not only more stable, but also a more attractive target for investment.

The downside of the model’s popularity is that it has generated tons of bad subscriptions. “A lot of boards and executives are now saying, Let’s get some subscription revenue, without thinking about why that would be good for the customer,” Baxter said. Paying a nominal fee for access to large content libraries, bulk discounts, gyms, or car shares can be a good deal, as long as you actually use the service, but the math can get a little trickier when a business is asking customers to pay for regular deliveries of a product: Some things go bad quickly or have especially thin margins, and a person’s need for a monthly box of raw meat or new types of hard liquor probably varies more than their desire to listen to music. Also, try as I might, I can think of no plausible long-term use case for something like Fabletics, which sends people monthly boxes of new workout clothes.

Subscription boxes have another notable downside: When you don’t use what’s sent to you, it piles up in your home or rots in your fridge, a regular reminder of fiscal and physical waste. Baxter describes that feeling as subscription guilt, and she says that it’s one of three big contributors to what she sees as growing fatigue with subscriptions as a concept. The other two will likely sound familiar: frustration at constant prompts to subscribe to products or services you’d rather own outright or pay for à la carte, and bad behavior by companies that trick people into signing up for subscriptions or make canceling difficult. These reactions don’t just affect the businesses that provoke them, Baxter said. They can cast a pall on the model as a whole, affecting people’s willingness to engage with very different products that share the same price structure. The more bad subscriptions there are, the harder a sell any new subscription is.

Being downwind of a consumer-subscription boom has also created a pricing problem. Many of the most popular subscription services began their lives as start-ups, which meant that investors flooded them with cash in hopes that they would acquire as many customers as possible, as quickly as possible. Typically, the services did so by losing money hand over fist, charging a nominal fee or offering months of free service or product to anyone who signed up. In theory, that would allow them to create an economy of scale, bringing in a little cash from a lot of people and bringing down the per-unit cost of whatever they were offering. In most cases, though, that hasn’t exactly worked out. Prices go up a lot, businesses lose a lot of customers, or both. Even in 2016, when meal-kit subscriptions were the new cool thing, the companies selling them lost as many as 90 percent of their customers within six months, once the steep discounts had expired. (Unfortunately for customers, highly successful subscription services also tend to become a worse deal over time, long after they’ve become profitable: Netflix, which cost $8 a month when I became a subscriber in 2011, recently raised its prices for the fifth time in seven years. Amazon Prime, too, recently announced rate increases for American customers.)

The phase we’re in right now might be best described as a subscription shakeout. As more markets become oversaturated with these kinds of services, more buyers will get bored of the concept entirely, and investors will eventually become weary of waiting for profit. At that point, a few common options are on the table: Some businesses will close entirely. Others will look for more funding to enable them to lose more money acquiring new customers, hoping to reach a sustainable scale. Others will go the traditional retail route, looking for more revenue by putting their products on shelves at big-box or grocery stores, no subscription required. Those with strong name recognition can sell chunks of equity to existing companies, as Birchbox did with Walgreens, which allowed the pharmacy chain to construct Birchbox displays of brand-approved beauty products in some of its stores. Some of the highest-profile subscription services cashed out before arriving at this phase, as Dollar Shave Club did in 2016 when Unilever acquired the company for a reported $1 billion—a deal now regarded as kind of a dud.

Baxter and Hardart both think that these types of moves are in many subscription services’ future, even if new owners keep the subscription aspect up and running—profitability is just easier if you suddenly have access to enormous pools of existing customers and the logistical operations that already serve them. Meal-kit boxes, for example, might be a good fit as part of an existing grocery business, where in-store customers can buy kits, and parent companies with fresh-food distribution channels can absorb the costly logistics of assembly. Many in the streaming industry, too, expect that the business is heading into an era of even greater consolidation—maybe Disney and Netflix will gobble up smaller services as a quick way to expand their own content libraries, or maybe Amazon will add Peloton’s on-demand workouts to the library of streaming options that comes with a Prime subscription.

The biggest players in their industries, though, likely don’t have much to worry about. Once millions of people have mistaken your service for a utility, you can do a lot before they reorder their lives to avoid paying for it. No one has ever liked a cable company, but it took a total revolution in technology to destabilize that business, which remains largely profitable even though it’s smaller than it used to be. Meanwhile, I still haven’t pulled the trigger on canceling Netflix, even though I’ve realized I don’t watch it at all for weeks at a time. I still want to see the Love Is Blind reunion, which won’t be available until Friday. And then I want to watch the new season of Drive to Survive, which comes out in a couple of weeks. That, according to Hardart, is what makes subscriptions such a good business. Once a company has you as a subscriber, the easiest, most friction-free thing to do is to continue subscribing. As long as it gives you just enough, you’re probably not going anywhere.