Why Cable and Broadcast Shows Still Matter for Streaming | Charts

Would Paramount+ have topped 60 million subscribers in the past quarter without shows from CBS, MTV and other sister divisions? It’s hard to know, but the streamer is far from alone in depending on more than just streaming-only originals, a new analysis shows.

Streaming services have long relied on a combination of original and licensed content to attract and retain subscribers. While original content helps establish a unique brand identity and drives new subscribers, licensed content serves as the backbone for these services, providing a rich and diverse library of titles that cater to a broad range of tastes and preferences.

Major studios, networks, and production companies, once content providers for a range of players, have now launched their own streaming services. This move has resulted in the fragmentation of content distribution and has made access to popular licensed content an increasingly challenging and expensive endeavor for streamers.

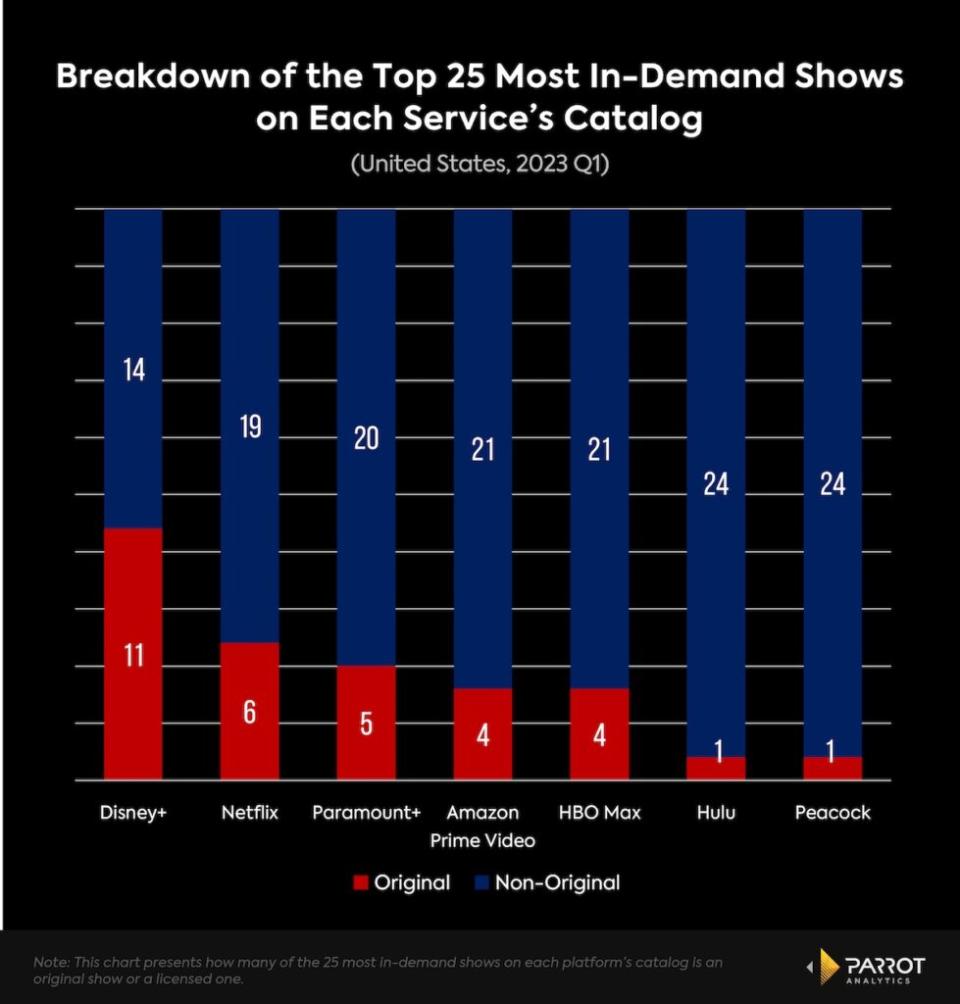

The chart below underscores the importance of non-streaming original content, which comprise the majority of the most in-demand shows. Services like Peacock and Hulu, which boast extensive libraries of licensed content, only have one service original among their top 25 most in-demand shows (“Poker Face” for Peacock and “The Orville” for Hulu).

Many of these popular shows might be called “snackable”: easy to consume, often light-hearted, and not demanding significant emotional or intellectual investment from the viewer. Designed for shorter viewing sessions or multitasking, these shows have transitioned from linear TV to streaming services in significant numbers, with several becoming top performers. For instance, “Saturday Night Live” and “The Office” were among the most in-demand shows on Peacock in the first quarter of 2023, while “The Simpsons,” “It’s Always Sunny in Philadelphia,” and “Family Guy” enjoyed similar success on Hulu.

Also Read:

What Past Hollywood Writers’ Strikes Tell Us About the Future of Movies

Even Disney+, known for releasing numerous original shows based on popular IP like “Star Wars” and the Marvel Cinematic Universe, has more non-original shows among its most popular offerings. Paramount+ similarly capitalizes on its popular IP, such as showrunner Taylor Sheridan’s output and the Star Trek franchise, to attract and retain its core fanbase. Among the top 25 most in-demand shows on Paramount+, five are originals, with four belonging to either the Star Trek or Sheridan IP.

It’s worth noting that not all non-original shows are licensed from third-party companies. In some cases, these shows may be owned in-house by a corporate sibling of the streaming service. This is particularly evident with HBO Max. Even though the service is set to drop the “HBO” from its name soon, eight of the 25 most in-demand shows, including hits like “Game of Thrones,” “The Last of Us,” and legacy shows “The Wire” and “The Sopranos,” premiered on HBO. Only four were Max originals.

A similar trend can be observed with Paramount+, where 12 of the 25 most in-demand shows come from networks under the same corporate umbrella, such as CBS, Nickelodeon, and Showtime.

Daniel Quinaud is a senior data analyst at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.

Also Read:

The Streaming Services That Are Priced Right – and the Ones That Miss the Mark | Chart